Is the ‘New Right’ Movement Blaming Small Businesses for Failing American Workers?

The ‘New Right’ disparages employers that fall short in providing “secure jobs,” but data indicate these tend to be small businesses

One of the key narratives of the “New Right” movement is that labor markets are failing American workers. But based on their own evidence, ‘New Right’ groups like the American Compass seem to (inadvertently) blame American small businesses for these labor market failures.

Last month the American Compass published a report entitled “Labor Markets Not Yet Working for Workers,” where they surveyed 1,000 working adults and assessed whether those workers had a “secure job.” The American Compass defines a “secure job” as one that must meet all 5 of these criteria:

Pays at least 40,000 a year

Provides health insurance

Provides paid time off (vacation/sick leave)

Allows for confidence in future earnings

Has regular or controllable schedule

Their report found that most jobs (over 60 percent of them) fulfill any one of these criteria, but only 40 percent fulfill all 5 of the criteria; so the conclusion of the report is that labor markets are not working for workers because only 40 percent of jobs are “secure jobs.”

A natural, follow-up question is: where are these “insecure” jobs coming from?

It turns out that most of these “insecure jobs” are likely jobs at small businesses that pay their employees lower wages and salaries, offer less access to medical care insurance, and provide fewer workplace benefits such as paid time-off or family leave. Highlighting this fact is not meant to indict small businesses in the slightest, given their essential role in the American economy. Rather it is important to clarify that, should the conversation turn to which businesses fall short in providing “secure jobs,” the data inevitably steers us towards small businesses by American Compass’ own criterion. This forces the American Compass into an odd position–blaming American small businesses for the ills they highlight in our labor markets.

Let’s look at the data.

Small Businesses Spend Less on Employee Wages, Salaries, and Benefits

Last month, the BLS released the findings of the National Compensation Survey (NCS) that was conducted in March 2023, in conjunction with the Department of Labor. One of the survey’s products is the “Employer Costs for Employee Compensation,” which provides the average employer cost for wages and salaries as well as benefits per hour worked.

One clear theme emerges from this data: The larger the employer, the more likely they will spend more on wage & salaries and benefits for their employees.

The graph above illustrates that small firms (with less than 50 workers) spend on average $8.20 for total benefits, $24.85 for wages and salaries, which means that the total compensation spent per worker amounts to $33.05.

Large firms (with 500 or more workers) spend on average $20.58 for total benefits, $38.90 for wages and salaries, which means that the total compensation spent per worker amounts to $59.47.

In other words, large companies spend about 80 percent more on their employees than do small businesses.

Small Businesses Offer Less Access to Medical Care Benefits

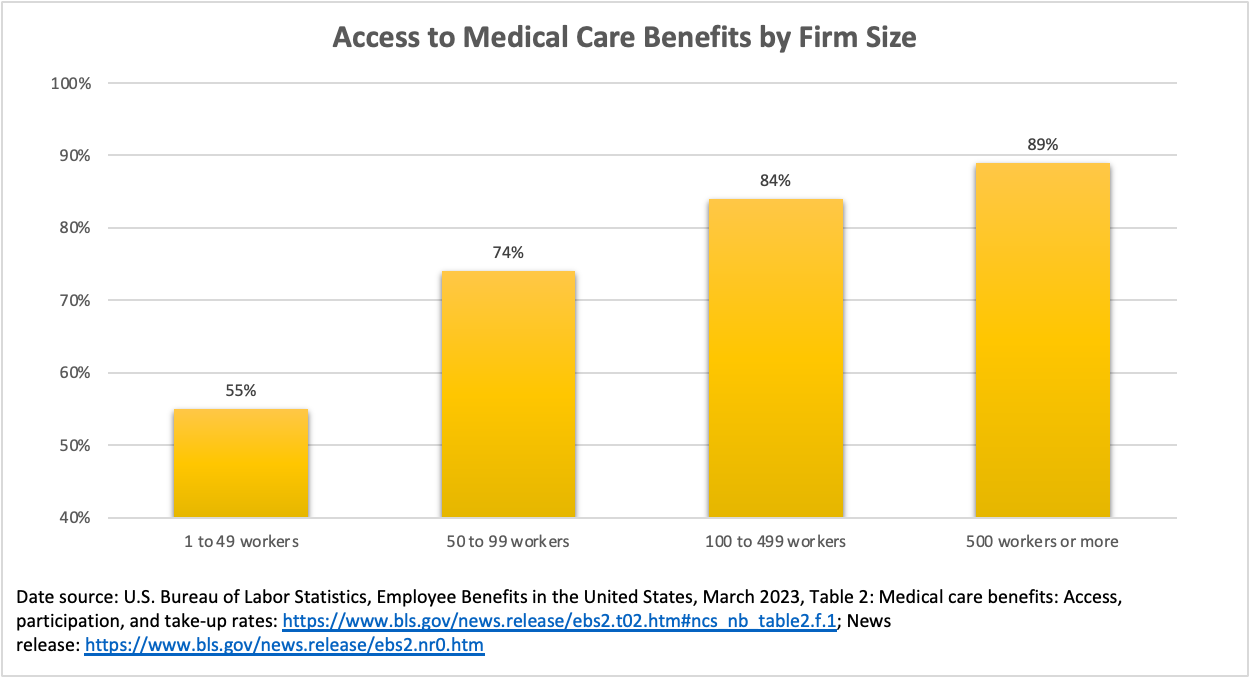

The American Compass also lists “provides health insurance” as one of their 5 criteria for a “secure job.” According to the March 2023 survey, the BLS reports that only 55 percent of small businesses (with less than 50 workers) provide access to medical care benefits to their employees, while 89 percent of large companies (with greater than 500 workers) provide access to medical care benefits to their employees.

Of course, based on our anecdotal experience, this is not a surprising finding. And, several other surveys illustrate this common experience that you’re more likely to get access to health care insurance if you work at a larger company. For example, the most recent version of the Kaiser Family Foundation (KFF) survey on health benefits finds that the likelihood of offering health benefits increase with firm size; only 49% of firms with 3 to 9 workers offer coverage, while virtually all firms with 1,000 or more workers offer coverage to at least some workers.

Small Businesses Provide Fewer Workplace Benefits such as Paid Time Off and Family Leave

The BLS reports on the percentage of workers with access to paid leave benefits (another American Compass criterion), by establishment size.

Again, a clear pattern emerges: the likelihood of offering paid leave benefits increases with firm size. Large firms are far more likely to provide personal leave, sick leave, vacation, and holidays to their employees than are small businesses. For example, less than 40 percent of small businesses offer personal leave while greater than 60 percent of large companies offer this benefit.

Paid maternity or paternity leave is another benefit that is most likely to be offered by larger firms. About 19 percent of small businesses offer paid family leave, while 37 percent of large companies with greater than 500 employees offer paid family leave.

What about other “perks”? The BLS also reports on access to “wellness benefits” – programs that may offer workers access to behavioral or lifestyle coaching, weight management, ‘healthy living’ programs or gym memberships. Only 23 percent of small businesses (with less than 50 employees) offer wellness benefits for their employees while 76 percent of large companies (with 500 or more employees) offer wellness benefits for their employees.

Again, for those of us who have worked at large companies or have friends working in “Corporate America” with their 6 months of paid maternity leave, subsidized gym memberships, and smoking cessation incentive programs, this is not surprising information. But it reminds us that when we disparage “companies” for failing to meet the needs of American workers, we’re mostly pointing the finger at small businesses. It’s also worth noting that these benefits are not always “free” because workers pay for them in less take-home pay.

Finally, the two remaining American Compass criteria seem to be met by almost all jobs: “Allows for confidence in future earnings” (85 percent of jobs) and “Has a regular or controllable schedule” (96 percent of jobs). It seems the American Compass is less worried about these aspects than the first 3 criteria on salaries and benefits.

American Compass and its (Inadvertent Defense) of Corporate America

This puts the American Compass in an awkward position: should it be defending “large corporations” for providing better pay and benefits for American workers and blaming small businesses for failing American workers?

As I wrote in a post last month on “5 Ways America Can Pursue a Pro-Worker Agenda,” small businesses are the backbone of American society. Creating a small business is often the source of income for underprivileged and minority workers. While there are some small businesses that make high profits, many small business owners, especially those with fewer than five employees and typical of your town’s “Main Street” establishment, can earn an average salary of $29,000 per year. That’s far below the national average mean wage. And that’s also why we don’t see small businesses top the charts for paying greater salaries and benefits to their employees.

The fact of the matter is that instead of trying to elevate one type of employer (large companies) over another type of employer (small businesses), we can accept that both types of establishments provide a thriving environment to meet the diversity of needs for workers in the United States. And it’s worth remembering that any policy proposals that would undermine or harm small businesses are also harming workers because a small-business owner is a worker who employs many other workers and, like those other workers, aims to make a living and sustain their family.

This calls into question the policy proposals advocated by the American Compass and other similar groups. Calls for new policies to force (small) businesses to increase wages or benefits are in practice calling for a transfer from low-income small business earners to low-income wage earners. And, these policies seem to unintentionally defend large companies and corporations that already do offer higher wages and benefits for their employees.

Instead, we should look to more positive, pro-worker policy solutions that generate a thriving labor market with an abundance and diversity of work opportunities, while at the same time offering reasonable safety-net measures that do not impede the beneficial aspects of our labor markets and the future economy. The future of America’s labor movement should be one that will benefit all types of workers, businesses, and the broader economy.

Did you write the recent Uber/Lyft article?