New Study: From Gig to Gone? ABC Tests and the Case of the Missing Workers

Our new causal analysis of state ABC test laws on labor market outcomes shows expected–and surprising–results

Freelancing, platform-mediated “gig” work, and other forms of self-employment are at an all-time high in the United States. Over a third of America’s workforce engaged in some type of independent work in 2023. While independent work continues to play a larger and unprecedented role in the economy, efforts have sprung up in recent years to regulate it.

Most notably, stricter worker classification laws, such as the ABC test, have emerged as the key response to tackle potential cases of misclassification (e.g., when a worker is functionally an employee but legally classified as an independent contractor). An ABC test limits the circumstances under which a worker can legally work as an independent contractor. Supporters of ABC test laws argue that those laws can address misclassification and induce employers to reclassify independent contractors as employees to comply with the law, thereby increasing the share of workers who are employees.

The challenge is that ABC tests make it more difficult for workers to engage in freelancing, gig work, or other types of independent contracting roles, even if those workers are already properly classified. This is partially because state policymakers have adopted broadly applied ABC tests that impact a wide array of industries, even in occupations and cases where there is no misclassification.

For example, when California codified their ABC test into law with Assembly Bill 5 (AB 5) in 2019, it led to a widespread backlash from legitimate freelancers in California who were no longer able to work (see, for example, the reports by Los Angeles Times, The New York Times, and Business Insider). As a result, California had to exempt over 100 industries and occupations from Assembly Bill 5. So, while policymakers aimed to address true misclassification, the ABC test functionally led to an overkill of properly classified independent contractors who lost their jobs.

Despite the interest and growth in ABC tests, there are no empirical studies that investigate the causal impact of those laws. Last year, our team at Mercatus published a study on California’s AB5–it was the first of its kind analyzing the employment outcomes in California post-AB5. Our AB5 study found that employment and self-employment fell in California for affected occupations post-AB5, but our study did not yield causal estimates due to the noisy nature of the data available (see our previous Substack posts “New Study on California AB5” and “A Deep Dive into our Study on California’s AB5”).

We now have those causal results. Coauthored with Markus Bjoerkheim, our new study provides the first causal analysis of state ABC test laws on labor market outcomes.

Our study asked the following question: What is the impact of an ABC test on traditional (W-2) employment, self-employment, and overall employment in states that have adopted these tests?

Our key results:

The introduction of an ABC test caused significant declines in traditional (W-2) employment, self-employment, and overall employment.

The ABC test reduced traditional (W-2) employment by 4.73%

Self-employment fell by 6.43%

Overall employment fell by 4.79%

Occupations with high shares of independent contractors experienced the largest reductions in employment.

These results suggest that contrary to the intended goal, ABC tests are not altering the composition of workers and leading to more workers becoming traditional W-2 employees, but they are reducing employment for both W-2 employees and self-employed workers.

Our full study will be published in the coming months. In this post, we preview our findings.

How did we do the study?

To evaluate the labor market impacts of the ABC test, we utilized what’s called the Callaway and Sant’Anna Difference-in-Differences (DiD) approach and an event-study framework tailored to settings with staggered policy adoption. These methods allowed us to leverage variation in the timing of the ABC test's implementation across states to identify causal effects, without introducing biases from diverse treatment effects or treatment timing.

We constructed a state-level annual panel dataset using the Bureau of Labor Statistics and Census Bureau’s Current Population Survey (CPS) monthly data from January 1990 to September 2024. This dataset allowed us to analyze employment outcomes, including overall employment, traditional (W-2) employment, and self-employment.

To analyze the worker-level labor market effects of the ABC test, we designated states that adopted the ABC test as the treatment states, and states that continued using right-to-control or common law standards as the control states. Through our legal history review, we identified nine states that implemented the ABC test for any domain, and we recorded the timing of the test’s adoption and the severity of its application. In some instances, the ABC test had been on the books for decades but only became applicable during our study period due to developments in case law. We consulted with a law firm to confirm the ABC test states and the timing of when the ABC test went into effect. These states are New Jersey, Massachusetts, New Mexico, Hawaii, Illinois, New Hampshire, Maine, Nevada, and California.

What do our results mean?

Our results show that when a state adopts an ABC test, it causes a reduction in traditional (W-2) employment, self-employment, and overall employment in both the short-run and the long-run (15 years).

Our key results:

The implementation of an ABC test caused a 4.73% decrease in W-2 employment, highlighting a substantial shift away from traditional employment forms, which is contrary to the goals of policymakers.

The implementation of the ABC test led to a 6.43% decline in self-employment.

The implementation of the ABC test caused a 4.79% reduction in overall employment in the state.

These numbers represent changes in employment in ABC test states relative to our control states (states that had the common law test). Occupations with high shares of independent contractors experienced the largest reductions in employment.

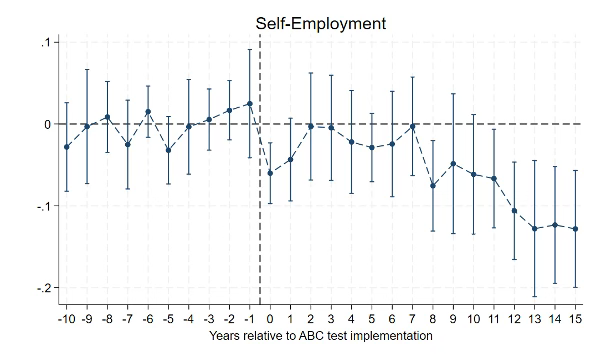

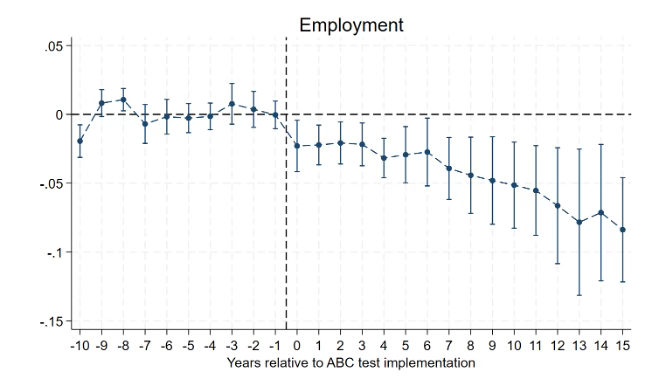

Below we have event study graphs that depict the negative effects of the ABC test on traditional (W-2) employment, self-employment, and overall employment over time, which also support our findings from our main DiD approach. The vertical dashed lines in those graphs represent the time the ABC test went into effect, and the y-axis coefficients show the estimated change in employment relative to the pre-implementation period (e.g. before the ABC test went into effect).

ABC Test Impact on Traditional (W-2) Employment

ABC Test Impact on Self-Employment

ABC Test Impact on Overall Employment

Both overall employment and traditional (W-2) employment exhibit a significant and sustained decline after adoption, worsening notably over the subsequent 5–15 years. In contrast, self-employment shows an immediate sharp drop following implementation, followed by a slight short-term rebound before experiencing a prolonged and pronounced decline.

These results highlight the ABC test's substantial negative effects on employment outcomes, with the largest negative impact on self-employment. While the decline in self-employment aligns with expectations that the ABC test makes it more difficult to work as an independent contractor, the reduction in traditional (W-2) employment was a surprise.

There are several reasons why an ABC test would cause traditional (W-2) employment to fall, though we could not inquire into these mechanisms given the nature of our data. One possible explanation is that businesses that had workers on payroll and also relied heavily on independent contractors shut down because of the ABC test (therefore causing W-2 employment to also fall). This is supported by anecdotal evidence coming out of California where employers started closing down their offices that had both W-2 employees and contractors (e.g., some of these stories). Therefore, businesses that had both W-2 employees and independent contractors moved to other states that don’t have an ABC test. Over time, there is a growth in W-2 employment in non-ABC test states relative to ABC test states.

Finally, we employed several robustness checks and all results remained consistent. Additionally, we excluded states that passed an ABC test immediately before, during, or after the financial crisis and the pandemic. Our findings are consistent even when excluding the financial crisis and pandemic environment.

Conclusion

Worker classification policies, such as the ABC test, have emerged as a key response to concerns about misclassification of gig workers and independent contractors. These policies aim to reclassify more workers as traditional (W-2) employees, granting them access to benefits and protections.

Our study provides the first causal analysis of the ABC test to measure its impact on labor market outcomes in the United States.

Our findings show that the ABC test does not lead to more workers becoming W-2 employees. Instead, an ABC test caused significant declines in employment: traditional (W2) employment fell by 4.73%, self-employment fell by 6.43%, and overall employment fell by 4.79%. Occupations with high shares of independent contractors experienced the largest reductions in W-2 employment.

These results suggest that ABC tests are not altering the worker composition, with more workers becoming traditional W-2 employees as intended, but they are reducing employment for both W-2 employees and self-employed workers.

I'm shocked, shocked I tell you!, to hear if you make hiring people more difficult or expensive, fewer people are hired.

That said, it's important to emphasize W2 employment (etc) decreased 4.7% _from what it could have been_, not in absolute terms.