A Fresh Look at the Independent Workforce with New BLS Data

New BLS data reveal the size and growth of the independent workforce, preferences for independent work over W-2 employment, and key demographic and industry trends

Earlier this month, the Bureau of Labor Statistics published the first news release on the much-anticipated survey on the gig economy. The Contingent and Alternative Worker Supplement (referred to as the CWS), which was last released in 2018, provides an official estimate on the size and characteristics of the independent workforce.

As part of her role on the Data Users Advisory Committee for the BLS, Liya had the opportunity to provide recommendations on updating the survey to better capture the evolving nature of independent work. Similarly, in 2019, the Committee on National Statistics appointed an expert panel, chaired by Susan Houseman (Upjohn Institute), to evaluate the shortcomings of the CWS and propose recommendations for its modernization.

Fortunately, the BLS implemented several of these suggestions. Most notably, for the first time in the survey’s history, they included questions about workers using alternative work arrangements as a secondary or supplementary job. Historically, the CWS focused exclusively on workers in their main or sole jobs.

Other surveys and administrative data sources show that the largest share of independent contractors are supplemental earners, especially those who use apps such as Uber, Lyft, DoorDash, and Instacart. App-based work was not included in this CWS release. The BLS intends to publish these additional estimates in the coming months.

In this post, we highlight some of the key findings on independent workers from the CWS survey. The results show that independent work as a primary job is growing, and that Professional and Business Services continues to be a top industry for these workers.

Some top-level results:

Approximately 11.9 million workers, or 7.4% of total U.S. employment, identified as independent contractors on their sole or main job, an increase from 6.9% in 2017.

However: This is understating the true size of the independent workforce since it’s only reporting on workers who use independent work as their primary source of income. The size of the independent workforce likely ranges from 11.9 million on the low end to 65 million on the high end (see Page 6, Table 1). Also, in an older WSJ article, Liya discussed similar issues with the 2018 CWS.

As in prior surveys, independent contractors overwhelmingly preferred their alternative work arrangements over W-2 employment (80.3 percent), whereas only 8.3 percent would prefer traditional, W-2 employment arrangements.

In 2023, 8.4 million people reported holding multiple jobs, representing about 5.2% of total employment.

However: This figure likely understates the true size of this group. Below we explain why the survey was unable to fully capture this data.

74.2 percent of independent contractors had health insurance, compared to 84.9 percent of workers in traditional W-2 arrangements.

Trends Over Time: Growth in Independent Contracting

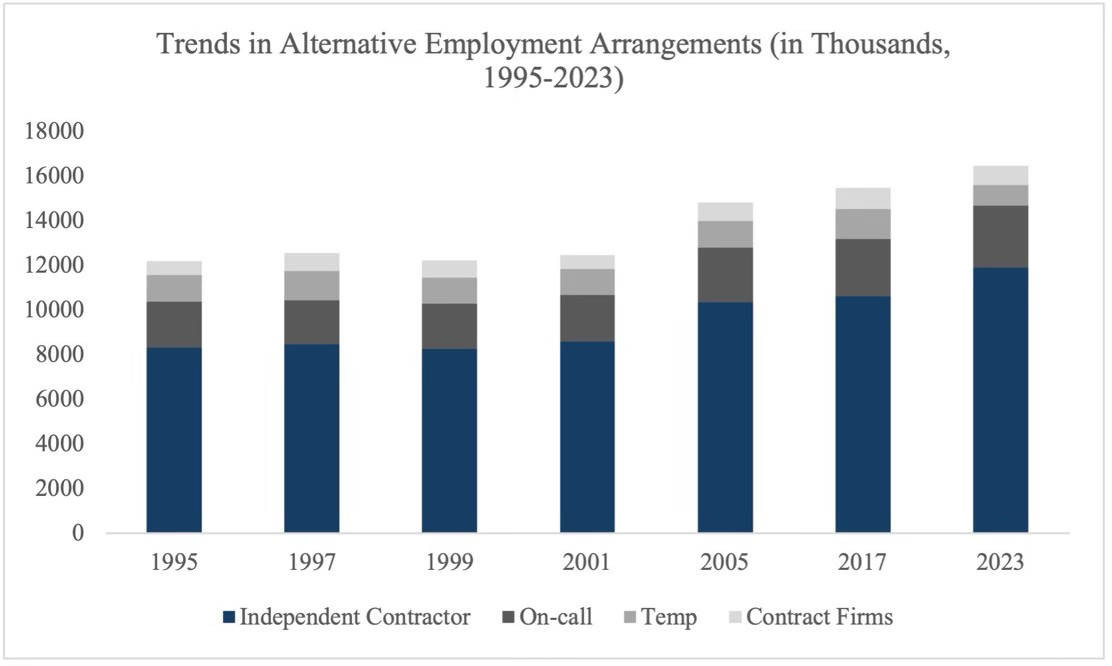

The contingent and alternative work arrangements survey is a supplement to the Current Population Survey (CPS) and has been conducted in 1995, 1997, 1999, 2001, 2005, 2017, and most recently in 2023. The CWS has two key parts of the survey—the first on contingent work (a temporary job, like a seasonal tour guide), and the second part on alternative work arrangements, which include independent contracting (e.g. freelancing, gig work, consulting), on-call work, temporary help, and contract firm employment.

The chart highlights the steady rise in independent contracting as a main or sole job, which increased from 6.7% of total employment in 1995 to 7.4% in 2023. Meanwhile, on-call work has remained relatively stable at around 1.7%, and temporary help agency work has declined from 1.0% in 1995 to 0.6% in 2023. Contract firm employment has fluctuated slightly but continues to represent a small segment of the workforce.

It’s unlikely that the rise in app-based delivery and transportation work is the reason for the growth in independent work as a primary job because app-based delivery and transportation workers tend to be supplemental earners (see Myth #2 here). An IRS tax data report also studied this question and concluded, “we find that the exponential growth in labor [online platform economy] work is driven by individuals whose primary annual income derives from traditional jobs and who supplement that income with platform-mediated work.” Furthermore, another IRS tax data report on independent contracting found that the significant growth in independent contracting since 2001 pre-dates the rise of the gig economy—similar to what the CWS data shows here.

Readers should be aware that CWS data is frequently misunderstood by the media, with many mistakenly equating independent contracting or alternative work arrangements with modern app-based gig work, such as ridesharing and delivery. However, app-based gig work represents less than 10% of independent contracting (see Myth #1 here). Additionally, the CWS has yet to release specific data on app-based gig economy jobs.

Lastly, 11.9 million workers is an understatement of the size of the independent workforce, as this figure only captures workers engaged in independent contracting as their primary job. Evidence from tax data suggests that the majority of independent contractors in the U.S. are supplemental earners, rather than primary income earners.

Industry Insights

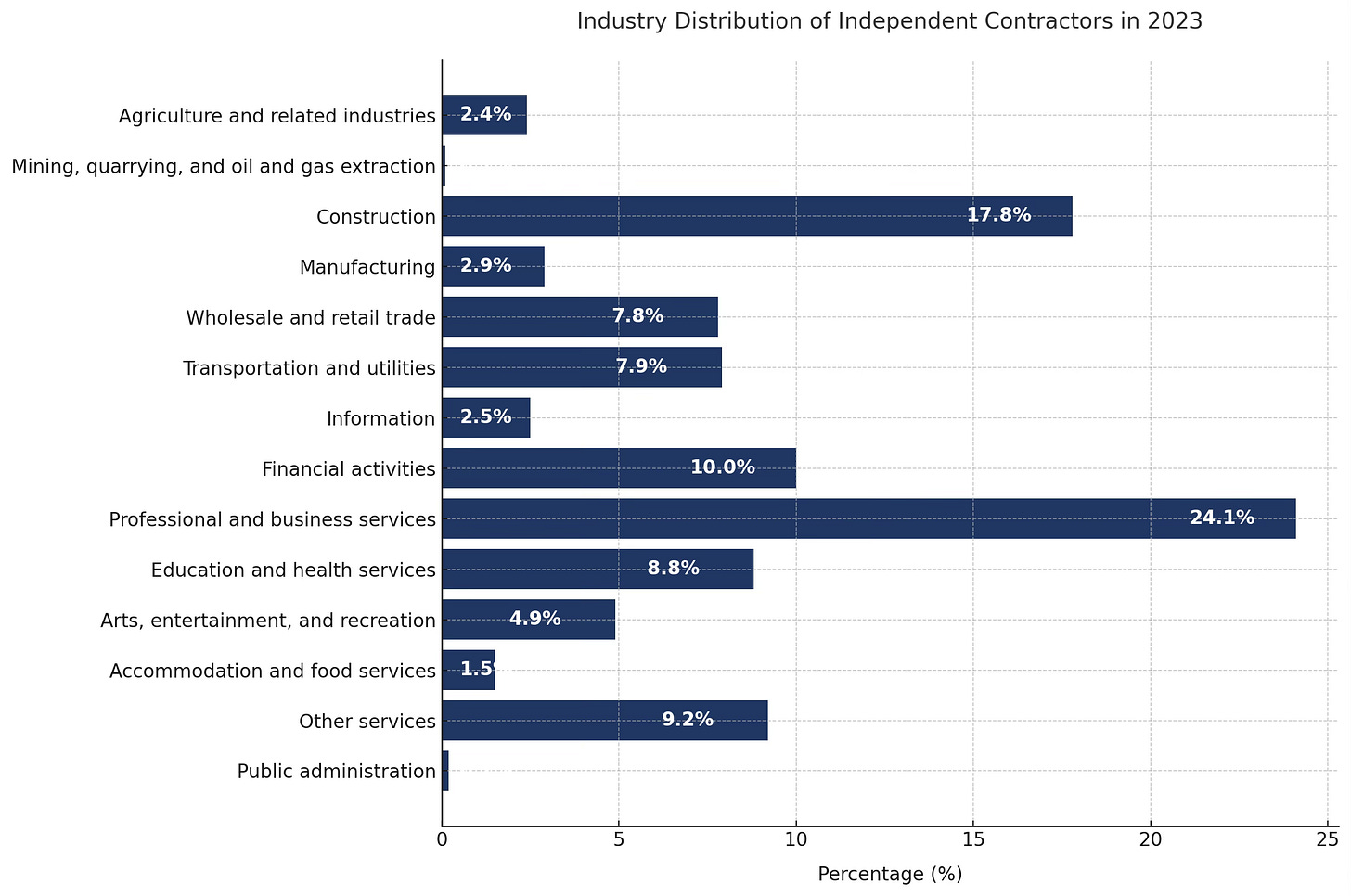

The survey highlights the share of all independent contractors working in specific industries, here are the top sectors:

Professional and Business Services: This industry remains the largest for independent contractors. In 2023, 24.1% of all independent contractors were working in Professional and Business Services, up from 21.3% in 2005.

This is consistent with IRS tax data sources which found that ‘Professional, Scientific, and Technical services,’ a sub-industry of Professional and Business Services, is the sector with the most independent contractors and has seen the greatest growth in independent contracting since 2001.

Construction: Construction continues to be a key industry for independent contracting, with 17.8% of all independent contractors in Construction in 2023, however, this represents a decline from 19.3% in 2017 and a more significant drop from 22.0% in 2005, suggesting a gradual shift away from this industry in terms of independent contracting.

We have not see a formal assessment on this yet, but it’s possible that this may partially be a reflection of state laws that have made it more difficult to be classified as an independent contractor in construction.

Financial Activities: 10% of independent contractors were working in financial activities in 2023, which has remained at about the same share in previous years.

Another way to analyze industry trends is to examine the percentage of workers in each sector who are independent contractors. From this perspective, the leading industry for independent contracting is Real Estate, Rental, and Leasing, where 24.2% of all workers are independent contractors (see chart below). In other words, nearly one in four workers in this sector is an independent contractor. With this new perspective, Construction (18.5%) and Professional and Business Services (13.5%) are still among the top 5 industries.

Demographic Trends: Independent Work Opportunities for Older Worker

The CWS data shows a significant upward trend in the employment share of independent contractors among men and women aged 55 and older from 1995 to 2023. Independent contracting as a main or sole job for older workers has increased by approximately 50 percentage points since 1995, while W-2 arrangements for older workers has increased by roughly 20 percentage points in the same time period.

Independent work can be valuable as a main source of income for retired or older workers who have moved past the “9-5” routine but remain open to transitioning to part-time or short-term flexible work. A 2020 study published in the American Economic Journal: Macroeconomics found that for many older workers, labor force participation near or after normal retirement age is limited more by a lack of acceptable job opportunities or low expectations about finding them than by unwillingness to work longer. The study found that about 60 percent of nonworking older respondents said they would be willing to return to work with a flexible schedule.

The CWS data on older workers is consistent with previous research—for example, a 2019 NBER study found that the incidence of self-employment among older workers was even higher than was previously measured. Conditional on working, the share of individuals with their main job as self-employment is less than 20 percent for the age groups 18-29 and 30- 49. But the share of individuals with self-employment income as a main job is 45 percent for 65-69 and almost 60 percent for those aged 70-74.

For many older workers, independent work can be an attractive way to ease into retirement or earn income when they are no longer part of the full-time, employment workforce. This is especially appealing to older individuals who already have healthcare coverage.

The Majority of Independent Workers Prefer Their Work Arrangements Over W-2 Employment

The 2023 data shows that 80.3% of independent contractors prefer their current arrangement over traditional, W-2 employment, an increase from 79% in 2017. In other surveys, workers cited dependent care obligations, personal circumstances, or a strong preference for job flexibility (over job stability) as the primary reasons. In particular, working mothers tend to prefer independent work arrangements because flexible work makes it easier for moms to juggle both parenting and their careers (see my previous posts on ‘The Future of Flexible Work is Female’ and ‘Celebrate Moms by Increasing the Availability of Flexible Work’).

The Puzzling Story about Multiple Job Holders

For the first time, the CWS surveyed multiple job holders: in 2023, 8.4 million people reported holding multiple jobs, representing about 5.2% of total employment. The most common alternative arrangement for a second job was working as an independent contractor, representing 22.8 percent of multiple jobholders.

The number of multiple job holders seems unusually low. Moreover, almost all other data sources indicate that independent contractors working as supplemental earners make up the majority of the independent workforce.

Susan Houseman, a member of the BLS Technical Advisory Committee, discussed this issue in a public BLS meeting, noting that the CWS survey asks workers about their jobs in the week prior. However, workers who have side jobs may not work those jobs every week; rather, they tend to work sporadically, especially those in the app-based gig economy. Additionally, the CPS generally identifies a much smaller population of secondary job holders, whereas other official data sources report higher numbers. For example, the U.S. Census Bureau’s Longitudinal Employer-Household Dynamics (LEHD) program finds that the multiple jobholding rate in 2018 was 7.8 percent. In the past, the Census Bureau’s Survey of Income and Program Participation (SIPP) also reported that there were 13 million U.S. workers holding more than one job, representing about 8.3% of workers.

We will dedicate a future Substack post to further analyzing the multiple-job holding component of the CWS once the BLS releases the raw data.

Looking Forward: Flexible Benefits for a Flexible Workforce

A 2020 Journal of Economic Perspectives study found that about 80% of self-employed workers indicated that they desire portable benefits—benefits that are not tied to one particular employer and can travel with the worker.

States are already experimenting with various portable benefits models. Last year, Liya testified before the Utah Legislature on a portable benefits bill that eliminates the presence of benefits as a factor in worker classification tests. This bill was passed and went into effect in May 2023. As a result, Target’s Shipt launched a pilot benefits program in Utah in partnership with the benefits company Stride. Similarly, with the support of Pennsylvania’s Governor, DoorDash introduced a first-of-its-kind pilot portable benefits program, also managed by Stride. Other portable benefits models, such as those in California and Washington state, mandate a specific set of benefits for contractors in app-based delivery and transportation sectors.

Congressional lawmakers are increasingly showing interest in these ideas. Earlier this year, Liya testified before the House Committee on Education and the Workforce about creating a safe harbor for states to experiment with portable benefits models. She also submitted a list of recommendations in response to Senator Cassidy’s request for information on portable benefits.

The key concept behind flexible benefits reforms is the recognition that current policies force workers to choose between independent work and access to fringe benefits. Flexible and portable benefits reforms aim to bridge this gap, enabling true independent workers and self-employed individuals to gain access to benefits.

To support independent workers in accessing flexible and portable benefits, Liya and Jonathan Wolfson recently published both a Federal and a State Policy Guide. These guides build on Liya’s previous research, including her 2023 policy brief and 2020 study on barriers to portable benefits solutions.

Thanks for this Liya - it really shows some of the challenges of measuring participation in the gig economy.

At Work 3 Newsletter, we included this as one of the best articles on the future of work ->

https://wrk3.substack.com/p/future-of-work-newsletters