Labor Myth Busting Series: The Gig Economy

The five biggest misconceptions about the gig economy that are leading to counterproductive policy solutions...

Image generated by DALL·E 3

P.S. Don't worry about AI too much yet, it doesn’t even know we have 5 fingers!

The growth of freelancing, contracting, and platform-mediated “gig” work over the last decade has been generating a lot of public attention. That’s because these workers are legally classified as ‘independent contractors’ (rather than as traditional, W-2 employees) and are not covered by many labor regulations and employment-based social insurance programs.

Broadly, these workers are referred to as the “independent workforce,” and they span across many industries. There are freelance writers, musicians, and graphic designers; Uber, Lyft, and DoorDash rideshare and delivery drivers; Instagram influencers and online marketplace sellers; construction workers, electricians, and plumbers; nannies, chiropractors, and tutors; and independent consultants in finance, technology, law, and accounting, among many others.

Today, about 10 to 29 percent of U.S. workers engage in independent work as their primary source of income, and up to 39 percent use it as a supplementary source of income. Estimates differ on how large the workforce is partially because of how we define the workforce. There are debates, for example, about whether to include “occasional” freelancers or whether to include online merchants and sellers on platforms like Etsy.

The attention on this workforce–especially on the “gig economy”–is driving a lot of state and federal policy responses. But there are five misconceptions about this workforce that are leading to counterproductive policy solutions.

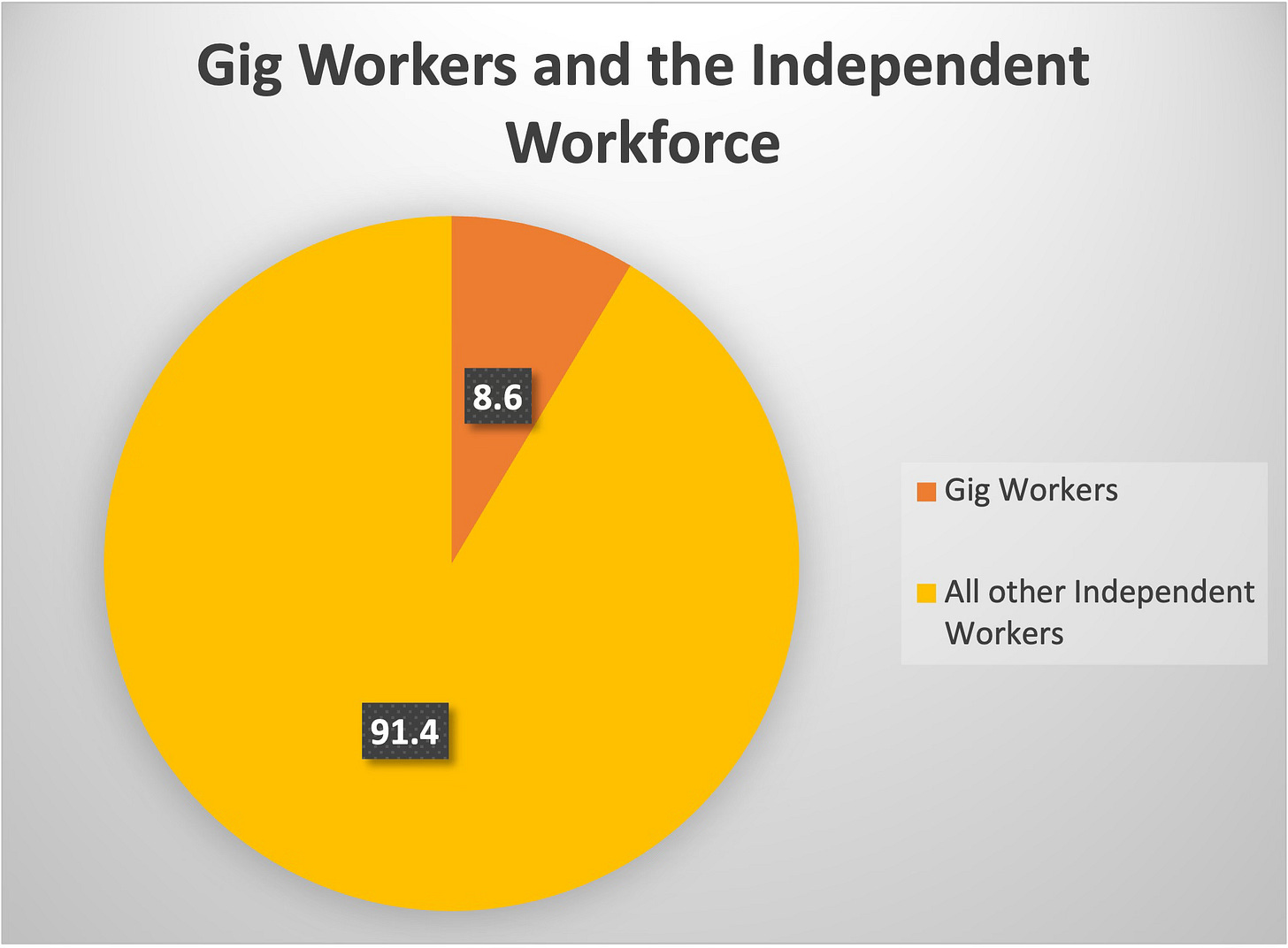

Myth 1: The Majority of the Independent Workforce Are “Gig Economy” Workers

“Gig workers” are commonly referred to as those who provide platform-mediated labor services such as ridesharing, food delivery, housekeeping, etc. While Uber, Lyft, and DoorDash are ubiquitous in our everyday lives, gig workers are a small subset of all independent workers. They amount to fewer than 10 percent of the overall independent contractor workforce. This is according to 1099 tax records, published by an IRS study. The study includes many of the largest online labor platforms as part of their measurements of the gig economy.

In a separate IRS study, researchers found that industries with the greatest share of independent contractors are “professional, scientific, and technical services,” followed by “health care” and “other services” (repair and maintenance, civic and religious organizations, etc.). All three of these industries have seen the greatest growth in the number of independent contractors hired since 2001.

Note: these studies using tax records predate the pandemic. A recent study also using IRS tax records found that during the pandemic, the number of workers with platform-based gig payments grew dramatically (over 150 percent). Despite this growth between 2020-2021, the “gig economy” still does not represent the majority of the independent contractor workforce.

Myth 2: The Majority of Gig Workers Are Full-time Earners on the App

This is one of the biggest myths regarding the gig economy.

The majority of workers using online labor platforms are using it as a supplemental job, not a primary job. In fact, the same IRS study referenced above concludes, “we find that the exponential growth in labor [online platform economy] work is driven by individuals whose primary annual income derives from traditional jobs and who supplement that income with platform-mediated work.” This was also true during the pandemic, with workers on these platforms continuing to be mainly supplemental earners.

Take a look at the company’s own economic reports:

Lyft: 96 percent of drivers work elsewhere or are students in addition to driving, and 95 percent of drivers drive fewer than 20 hours a week

Doordash: 90 percent of ‘Dashers’ worked less than 10 hours per week on delivery

MIT Economist Jonathan Gruber also finds a similar pattern when surveying Uber drivers:

62 percent of Uber drivers work on top of a full-time or part-time employment (W-2) job or are also students

18 percent work only on ridesharing/food delivery platforms (including other platforms besides Uber)

The remainder are either retired, own their own business, or are unemployed

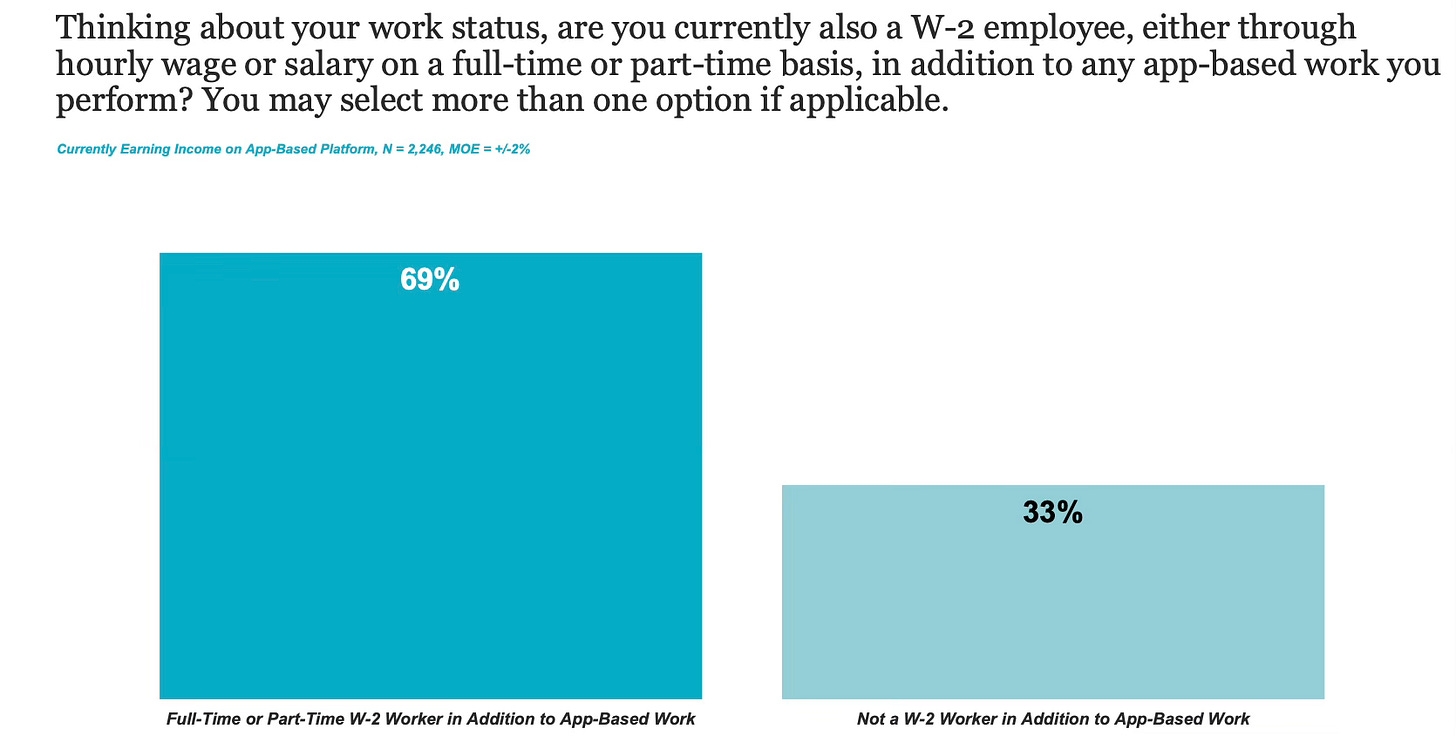

Another survey that aggregates workers from across the major app-based industries also finds that 69 percent of app-based workers already have a full-time or part-time W-2 job.

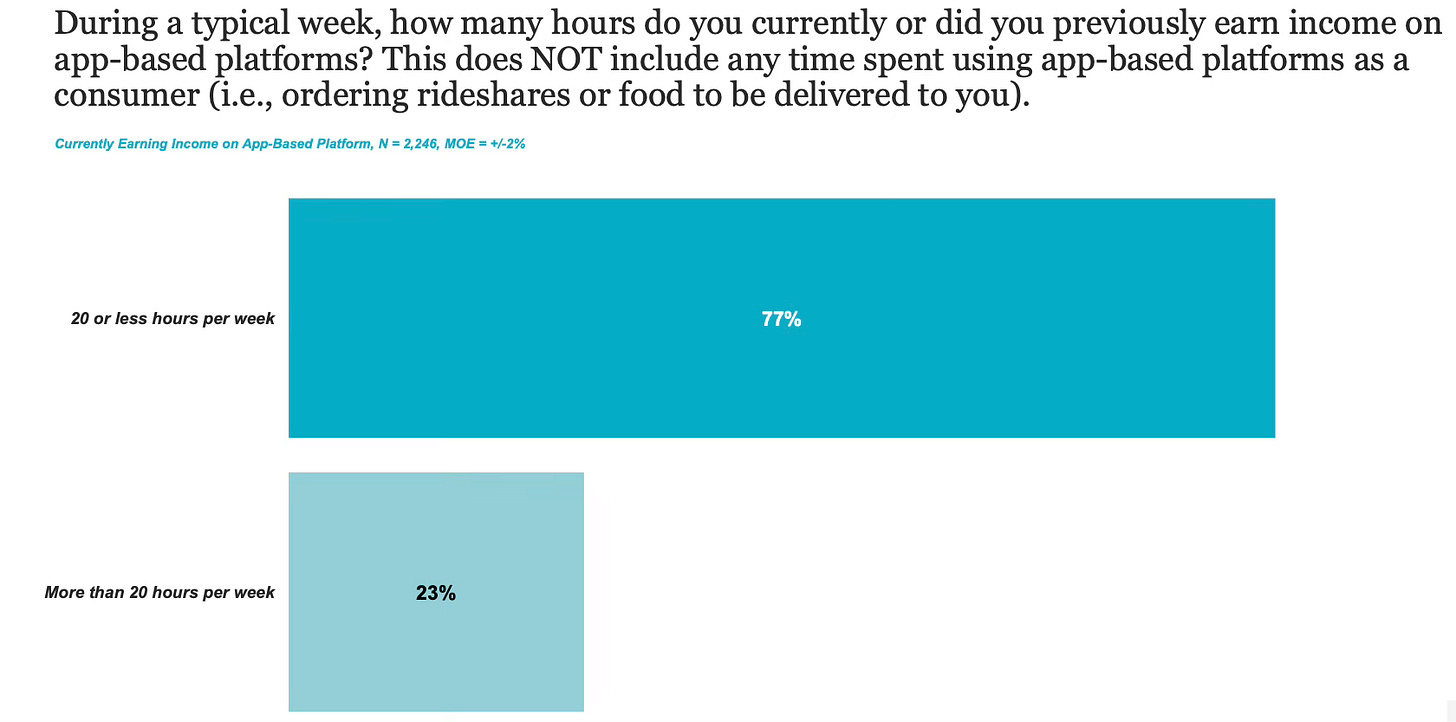

Similarly, about 77 percent of app-based workers also indicated that they work on those platforms less than 20 hours a week.

The supplemental nature of independent work is not only true among gig economy workers, it is also representative of the entire workforce. According to the IRS data, the largest largest share of independent contractors are supplemental earners who have full-time jobs elsewhere. This is corroborated by several other studies, including one by the Economic Policy Institute.

Myth 3: Most Gig Workers Don’t Have Access to Health Insurance

According to Jonathan Gruber’s study on Uber drivers referenced above, the majority of Uber drivers (77 percent) are insured. This is below the national rate for workers (89 percent). Among those Uber drivers who receive insurance, 52 percent receive it either through their employer in their primary job or through a family member’s employer. Gruber notes that, interestingly, the monthly reported costs of insurance for those with employer insurance are about the same as those who buy it on their own.

This also may help explain another unique finding in Gruber’s survey: “There is a clear preference for retirement savings over other forms of benefits, while contributions towards health care or health insurance are valued least highly.”

I suspect we would find similar results with other app-based companies given that the entire industry is characterized by supplemental earners who already have W-2 full-time or part-time jobs.

However, this would not necessarily be the case for other independent contractors outside of the “gig economy” who make their primary income through contracting rather than through traditional W-2 employment. That may include professional freelancers like graphic designers or writers or independent contractors in industries like construction or home delivery who tend to do this type of work as their full-time jobs.

Myth 4: Independent Contractors Want To Be Traditional Employees

A vast majority (79 percent) of independent contractors prefer their nontraditional work arrangements over a traditional employment arrangement, according to the Bureau of Labor Statistics’ Contingent Worker Supplement. Only 1 in 10 independent contractors would rather have a traditional employment arrangement.

This is not surprising given that workers who turn to independent work tend to have a strong preference for flexible work arrangements. Uber drivers would require salaries almost twice their earnings to accept an inflexible, taxi-like schedule. And for the top 10 percent of DoorDash couriers, losing flexibility is equivalent to a 15 percent pay cut.

For the broader independent workforce, an Upwork survey found that approximately 73 percent of individuals engaged in independent work do so because of the increased flexibility of their work. Workers cite that independent work gives them the flexibility to be more available as a caregiver for their family or to address personal mental or physical health needs.

As I wrote about in my previous post on “The Future of Flexible Work is Female,” women who are primary caregivers are especially drawn to these independent work opportunities as it gives them the opportunity to balance work and motherhood. A 2023 survey highlighted the growing share of women switching from traditional full-time employment to independent work opportunities, mainly because these women prefer to work from home and want more flexibility in their schedules.

A recent study analyzing panel data from the Survey of Income and Program Participation (SIPP) and American Time Use Surveys shows that self-employment rates are higher for women who have young children. That study also indicated that self-employed female workers have more flexibility on average in their work location, hours, and schedule as compared to women in traditional employment. Mothers with young children at home use self-employment opportunities to spend an additional two hours per day with their children. The study concludes that overall, these non-traditional work opportunities give mothers “more control over their work environment allowing them to better manage their household while working.”

IRS tax data also shows that female independent contractors are more likely to have children than female employees, and that the participation in independent contracting since 2001 has grown significantly more among women than among men.

Myth 5: Large companies Are Primarily to “Blame” for the Growth of Independent Contracting

There seems to be a perception that large companies are to blame for the growth of independent contracting over the last few decades. According to IRS tax records, this is not the case. The growth of independent contractors has been the fastest for small and low-wage businesses (fewer than 20 employees), followed by medium firms (20-100) and lastly by large firms (more than 100).

As I point out in a previous post, it’s important to remember that many small businesses do not provide healthcare insurance, retirement benefits, or maternity benefits to their employees, meaning the “benefits” differences between an independent contractor and an employee at a small business are smaller than expected.

In Sum:

Gig workers are only a small subset of all independent contractors.

The majority of gig workers already have a full-time or part-time W-2 job and are supplemental earners on app-based platforms. This is also true of the broader independent contractor workforce, most of whom are supplemental earners.

Most gig workers already have access to health insurance coverage and value healthcare benefits less than other types of benefits.

Independent contractors and gig workers significantly value the flexibility that comes with their non-traditional work arrangements and most would not prefer to be W-2 employees.

Since 2001, the growth in independent contracting has been fastest among small firms, not large companies.

While a full-time Uber driver who wants traditional employment might be the image of an independent contractor that comes to mind, it’s important to note that this individual is not representative of the gig economy or the independent workforce more broadly. Typified by their diversity and breadth, independent contractors (and gig workers specifically) tend to be supplemental workers, who have health insurance, and significantly value the flexibility of their jobs and the ability to earn extra income.